BTC Price Prediction: Volatility Ahead Amid Technical Weakness and Institutional Accumulation

#BTC

- Technical Divergence: Price below 20MA but MACD shows weakening bear momentum

- Market Dichotomy: Whale selling counterbalanced by institutional accumulation

- Key Levels: $109K support and $123.5K resistance define near-term range

BTC Price Prediction

BTC Technical Analysis: Short-Term Bearish Signals Emerge

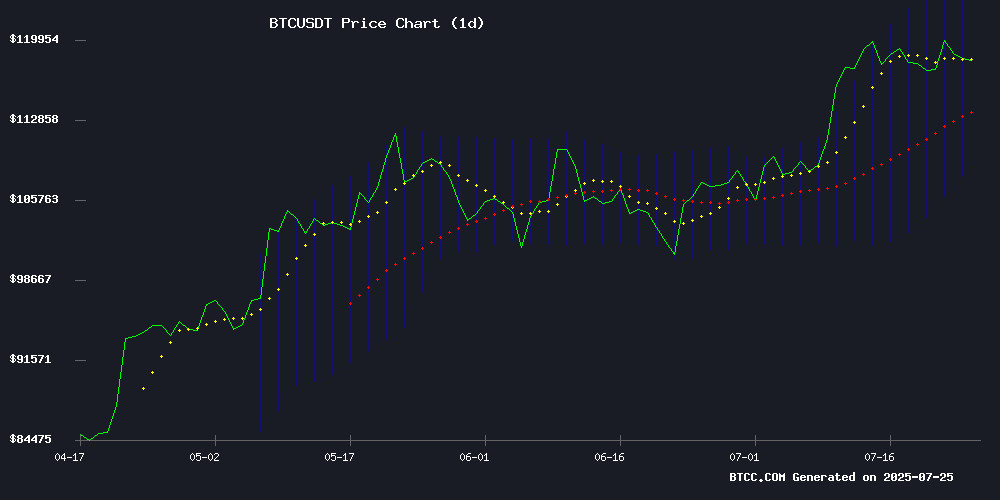

BTC is currently trading at $115,460, slightly below its 20-day moving average of $116,299, indicating potential short-term weakness. The MACD remains negative (-4,045.08), though the histogram shows a slight convergence (1,097.27), suggesting slowing downward momentum. Bollinger Bands show price hovering NEAR the middle band, with resistance at $123,585 and support at $109,014.

"The technical setup suggests cautious consolidation," says BTCC analyst Emma. "A break below $109K could trigger further downside, while reclaiming the 20-day MA may signal stabilization."

Mixed Signals: Whale Activity and Institutional Demand Clash

Recent whale movements ($1.67B transferred to exchanges) contrast with strong ETF inflows ($226M) and institutional expansion (ProCap merger, Christie's crypto initiative). "This reflects a market at crossroads," notes BTCC's Emma. "Whale selling pressures prices, but structural demand from ETFs and real-world adoption provides underlying support."

Factors Influencing BTC’s Price

Bitcoin Price to Drop Below $100K? Top Analyst Warns Of Sharp Fall

Bitcoin faces renewed volatility as analysts flag a potential breakdown from its rising wedge pattern. The cryptocurrency slipped 1.9% to $115,710 after losing critical support at $118,000, with whale activity exacerbating the decline.

Galaxy Digital's reported sell-off of 10,000 BTC ($1.18B) and $370M USDT withdrawal triggered a 3% hourly plunge, liquidating $144M in long positions. Thin liquidity magnified the impact of institutional moves during low-volume trading periods.

Technical analyst Captain Faibik identifies $113,000 as the decisive level—a daily close below this threshold could confirm bearish momentum. Market participants now watch whether Bitcoin's institutional adoption narrative can outweigh technical headwinds.

Massive Bitcoin Transfer Sends Market into Turmoil

Bitcoin plunged to $115,080, its lowest level in two weeks, following a significant transfer by Galaxy Digital. The financial services firm moved 10,000 BTC, worth approximately $1.18 billion, to cryptocurrency exchanges. Analysts interpret this as a profit-taking maneuver.

Shortly after the initial transfer, Galaxy Digital sent an additional 2,850 BTC ($330 million) to exchanges, exacerbating selling pressure. The consecutive large-scale transactions flooded the market with liquidity, weakening buyer momentum and stifling Bitcoin's price recovery.

The transfers triggered widespread liquidations across crypto markets. Bitcoin briefly touched $115,378 before stabilizing near $115,404—marking its lowest point since July 10. Market participants now watch for whether institutional selling will sustain downward pressure.

Bitcoin Slips Below Key Support Amid Whale Movements and Market Weakness

Bitcoin fell 2.56% to $115,200 as large holders transferred millions to exchanges, sparking fears of a sell-off. Galaxy Digital moved 3,500 BTC ($404 million) to centralized platforms, while another 1,500 BTC ($176 million) went to unidentified wallets. These transactions marked one of the largest single-day exchange inflows in recent weeks.

Technical indicators turned bearish, with MACD showing a crossover at -166.78 and RSI cooling to 62.21. BTC briefly touched $115,240 but failed to reclaim its 7-day moving average at $118,257, triggering automated sell orders.

The broader crypto market declined 2.72%, with Bitcoin ETFs seeing mixed flows—$227 million in inflows on July 24 but $131 million in monthly outflows. Market sentiment remains fragile as institutional activity and technical signals point to continued pressure.

Christie’s Launches $1B Crypto Real Estate Division, Accepting Bitcoin for Luxury Properties

Christie’s International Real Estate has established a specialized division for cryptocurrency transactions, enabling buyers and sellers to bypass traditional banking channels. The new unit, spearheaded by Southern California CEO Aaron Kirman, oversees a $1 billion portfolio of properties exclusively available for crypto payments.

The initiative builds on previous high-profile deals, including the $65 million sale of a Beverly Hills mansion. Regulatory tailwinds support the move—the Federal Housing Finance Agency recently directed Fannie Mae and Freddie Mac to consider crypto as reserve assets in mortgage risk assessments. Current listings include Bel Air's $118 million La Fin mansion and Joshua Tree's $18 million Invisible House, both priced in Bitcoin.

A dedicated compliance team of legal experts and blockchain analysts will verify the provenance of crypto assets used in transactions. "We're creating a secure bridge between digital wealth and tangible assets," Kirman noted, underscoring the growing institutional embrace of cryptocurrency.

Bitcoin ETFs See $226M Inflows Amid Price Dip as Fidelity, VanEck Lead Demand

US Bitcoin spot ETFs snapped a three-day outflow streak with $226.6 million net inflows Thursday, defying BTC's 2.17% price drop to $115,080. Fidelity's FBTC dominated with $106.6 million inflows, followed by VanEck's HODL ($46.4M) and BlackRock's IBIT ($32.5M), signaling institutional conviction during market volatility.

The reversal comes after consecutive outflows totaling $285.3 million earlier in the week. This divergence between ETF demand and price action suggests sophisticated investors may be accumulating during pullbacks, while retail traders react to short-term price movements.

14-Year Bitcoin Whale Moves $1.67B in BTC to Exchanges, Triggers Major Sell Activity

A long-dormant Bitcoin whale has awakened, transferring 14,273 BTC—worth approximately $1.67 billion—to cryptocurrency exchanges within a 12-hour window. The movement, tracked by on-chain analyst @ai_9684xtpa, was routed through Galaxy Digital and included a single-hour transfer of 5,690 BTC. Over 10,000 BTC were subsequently sold on Binance within four hours, with Galaxy Digital withdrawing USDT following the deposits—a clear confirmation of real selling activity.

The sudden influx of Bitcoin into the market has raised concerns about short-term volatility. Such large-scale movements from historic holders often signal strategic positioning, whether for profit-taking or portfolio rebalancing. The market now watches closely to see if this marks a localized event or the beginning of broader distribution.

Strategy Quadruples STRC Offering to $2 Billion for Bitcoin Accumulation

Strategy has aggressively expanded its STRC preferred stock offering from an initial $500 million target to $2 billion, signaling intensified commitment to Bitcoin acquisition. The revised structure prices shares at $90—a 10% discount to the original target—while offering a 9% floating dividend with monthly adjustments.

Morgan Stanley, Barclays, and Moelis are leading the capital raise, which explicitly earmarks proceeds for BTC purchases and general corporate purposes. The securities sit above STRK/STRD classes in capital structure but remain subordinate to Strife debt instruments.

Legal complications persist as a Delaware class-action lawsuit alleges improper amendments to prior STRK stock terms without shareholder approval. The case remains in preliminary stages, with Strategy dismissing claims as premature.

Bitcoin Whale Bets $23.7M on BTC Rally to $200K by Year-End

A Bitcoin whale has placed a $23.7 million bullish options bet targeting a year-end price of $200,000 for BTC. The trade, executed on Deribit, involves a bull call spread—buying 3,500 $140,000 December call options while simultaneously selling 3,500 $200,000 December calls. This strategy caps potential losses at the initial debit while offering maximum profit if BTC settles at or above $200,000 by expiration.

Deribit Insights noted the trade exploits volatility differentials, funding the lower-strike call purchase with premium from the higher-strike sale. Such sophisticated positioning signals strong institutional conviction despite Bitcoin's recent price consolidation. Options activity continues to reveal whale expectations of significant upside, with this structured play effectively betting on a 200%+ rally from current levels.

Bitcoin Nears All-Time High Amid Low Macro Risks

Bitcoin teeters just below its record peak, sparking speculation about further upside. Swissblock analysts note the unusual absence of macroeconomic headwinds—a historical precursor to sustained rallies.

Buyers appear strategically positioned, ready to capitalize on volatility. Short-term investors remain cautious; a 17% surge could trigger profit-taking alerts, but no panic selling looms yet.

ProCap BTC to Merge with CCCM in Strategic Move for Institutional Bitcoin Expansion

ProCap BTC, led by Anthony Pompliano, has taken a significant step toward merging with Columbus Circle Capital Corp I (CCCM) by filing a confidential draft registration statement on FORM S-4 with the U.S. SEC. The proposed business combination, announced on June 23, 2025, aims to accelerate institutional adoption of Bitcoin through enhanced capital access and public market visibility.

The merger will create ProCap Financial as the operating entity, focusing on Bitcoin holdings, education, and institutional services. A private placement and convertible note offering targeting qualified institutional buyers will support the combined company's growth trajectory. Pompliano emphasized the team's efficiency, noting the S-4 submission occurred just 31 days after the initial announcement.

Satsuma Technology Raises $135M in Record UK Bitcoin Treasury Initiative

London-based Satsuma Technology has secured $135 million in a landmark Bitcoin treasury funding round, setting a new UK record. The capital, expected to be fully received within two weeks, will propel the firm into the ranks of Britain's top corporate Bitcoin holders by market value.

The raise was structured as a secured convertible loan note offering, targeting institutional and accredited investors globally. Fortified Securities managed non-US allocations, while Dawson James Securities handled the US private placement—a strategic move to attract investors aligned with Satsuma's decentralized technology vision.

Proceeds will fuel expansion of the company's AI and blockchain operations, strengthening its position within the UK's burgeoning Bitcoin ecosystem. This development underscores growing institutional appetite for cryptocurrency exposure amid broader market adoption.

Is BTC a good investment?

BTC presents a high-risk/high-reward proposition currently:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | -0.7% below | Short-term bearish |

| MACD | Converging | Potential trend reversal |

| Whale Activity | $1.67B sell pressure | Near-term downside risk |

| ETF Inflows | $226M weekly | Institutional support |

"Dollar-cost averaging remains optimal," advises Emma. "The $109K support and institutional developments could limit severe drawdowns."

1